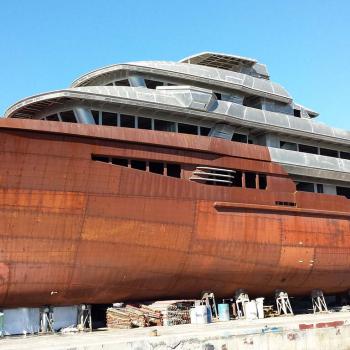

When it comes to acquiring or building a yacht, any potential owner will need to consider whether they will need securing external finance to help support the purchase. High-value assets, such as superyachts, are financed only by a small group of specialised banking firms and financial institutions and options may be limited and should be explored from the start of any new project.

For yachts of 40 meters or less of length it is more frequent to see leasing arrangements whereby a financial institution buys the yacht to lease it over a long-term agreement with the possibility of purchasing it at a price agreed at the outset. For larger yachts it is, however, more frequent that lenders offer bilateral loans whereby the borrower has title to the yacht, but the lender has a mortgage over it and use it as a collateral until full repayment.

A point borrowers need to consider is the maximum amount or percentage they can finance a yacht for. Indeed, there is no set rule, and the financing amount depends on the mix of parameters, ranging from the quality of the asset, the track record of the builder and the relationship of the borrower with the selected financial institution. The prospective owner’s business activities, net worth and income stability can also play a factor when it comes to financing a superyacht, as the lender could well be supporting the loan as part of a strategic step to develop a broader relationship.

Also, not all owners may be eligible to financing as this may be dependent on several factors, such as the main business of the borrower, the country of build or purchase or the identity of the seller. Financial institutions must comply with several complex international and local laws and sanctions regulations and no flexibility is permitted on these subjects.

Our team of experts assists borrowers and lenders in navigating the implications of the different types of financing structures, such as construction financing, purchase financing, loan purchase and refinancing, as well as financing rates (fixed or floating). They can document and negotiate the full suite of documents from loan agreements to assignment of insurances and coordinate the closing and drawdown process helping the parties in reaching their objectives.